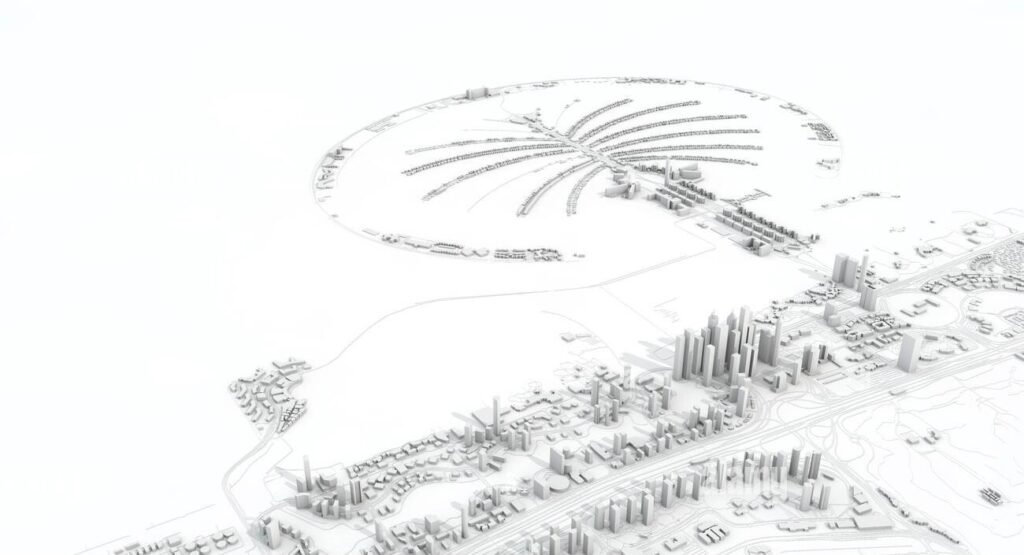

" In Dubai, Every Ambition is Welcomed, Every Vision Nurtured.

Begin Your Business Journey in the Heart of Innovation "

How It Works

Get Your Business Registered In Dubai

Why Dubai Is The Best Choice For You

Dubai's central, global market access

No personal, capital gains, corporate taxes

Simplified business setup and licensing

World-class airports, seaports, modern facilities

Politically stable, robust, diversified economy

Welcomes diverse industries, business sizes

What Our Clients Say

Frequently Asked Questions

Dubai offers a dynamic business environment with strategic global access, a tax-friendly system, world-class infrastructure, and a diverse, skilled workforce. It’s an ideal hub for businesses looking to expand in the Middle East and beyond.

You can choose from several business structures in Dubai, including Sole Proprietorship, Limited Liability Company (LLC), Free Zone Company, Offshore Company, and Partnership. Each has unique features and benefits suited to different business needs.

Free Zones are special economic areas in Dubai offering 100% foreign ownership, full repatriation of profits, no import-export taxes, and minimal bureaucracy. They’re ideal for international businesses seeking a foothold in the UAE market.

The process involves choosing a business activity, registering a trade name, applying for a business license with the Department of Economic Development (DED) or relevant Free Zone authority, and fulfilling any specific regulatory requirements.

Yes, in Dubai, there are no restrictions on the repatriation of profits and capital, which is a significant advantage for foreign investors.

Business owners can apply for investor visas, which allow them to reside in the UAE. The duration and eligibility depend on the investment size and the type of business setup.